* To download the free tuition spreadsheet, please scroll down to the bottom of this post, where you will find a link to open and download the Excel file *

As a student, it’s important to know just how much your academic program is going to financially cost you. While having a clear understanding of not just the grand total of your financial requirements is important, having an understanding of your financial requirements on a semester-by-semester basis is also important.

If you would like a free tuition and school fee calculator, I am happy to provide you with the spreadsheet that I created for myself (and fellow classmates) back in my days of PT school. Within this blog post, I will provide a quick run-through of how to access it and use it.

Be as financially informed as you can possibly be

If you’re getting ready to head off to PT school (or any similar health professions program) I would encourage you to be as financially informed as possible throughout the entire process, including knowing how much money you’ll be needing through all points of the journey.

I say this because not being responsible and/or well-informed with student finances can lead to a stressful time while in school. Thereafter, it can lead to an unwarranted amount of student loan debt if you’re not careful. I don’t want you to find yourself in either of those situations, so I’m hoping you can do all that you can to financially plan your schooling out appropriately.

Remember: The greater your understanding of your academic financial requirements, the less stress you will likely have.

As someone who takes finances very seriously, if you’d like more information pertaining to navigating the world of finances, budgeting student loans, etc., then I’d suggest you head over to Daveramsey.com to explore the many resources they can provide you with to help you with your financial life.

Why I created this spreadsheet

When I found myself entering the first semester of my PT schooling, I didn’t have a clear understanding of how much money I was going to need to borrow or pay up front for each semester. My school provided no information pertaining to how much each credit per semester was going to run. While I found this to be very frustrating, I simply started taking matters into my own hands.

I began asking all of my classmates if they had any idea, and as it turned out, they all were unsure as well and also wanted answers. After arranging discussions with the chair of the department, a classmate and I finally got a breakdown of tuition costs for our PT program based on credit hours.

Armed with this information (which was exactly what I needed), I then created a spreadsheet to calculate my financial requirements on a semester-by-semester basis and then sent it out to all of my classmates so that they could use it for themselves as well.

I’ve since updated this spreadsheet for you and have made it even better

In order to provide as much benefit to anyone who uses this spreadsheet, I made a few updates to it since when I first created it. Feel free to modify things within it however you need in order for it to fit your own personal needs.

I’ve also included a sample spreadsheet that you can reference within the excel file (on a separate tab) in case you’re not quite sure of how to fill anything out or what exactly to fill out. If you’re not quite sure which areas to fill out on the spreadsheet, referencing the sample spreadsheet should come in quite handy.

A quick overview of how to use this spreadsheet

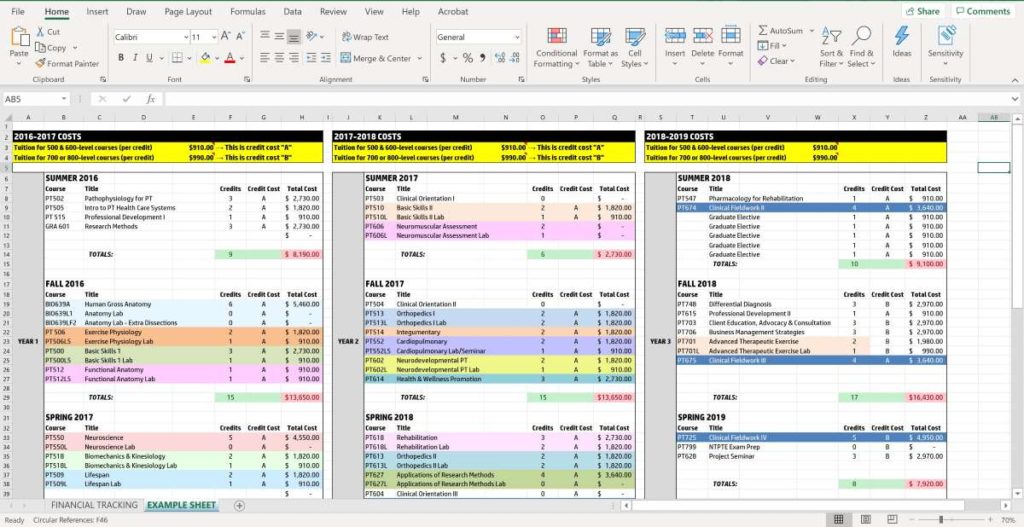

When you open this spreadsheet, you’ll see that it provides three years of academic semesters (summer, fall & spring). It’s been ordered this way since school for me began in the summer – feel free to make changes as needed.

You’ll notice that the three columns (Year one, year two and year three) are essentially identical, so if you know how to fill out the first column, you’ll know how to fill out the second and third one.

What you’ll need to know, and what you’ll need to do.

You will need to know the following three pieces of information in order to use this spreadsheet:

- The courses that you’re taking for a particular semester

- How many credits each course is worth

- The credit hour cost per course

As long as you know the courses you’re taking each semester, how many credits each course is worth, and how much each credit hour costs, you’ll have all you’ll need in order to make this spreadsheet work.

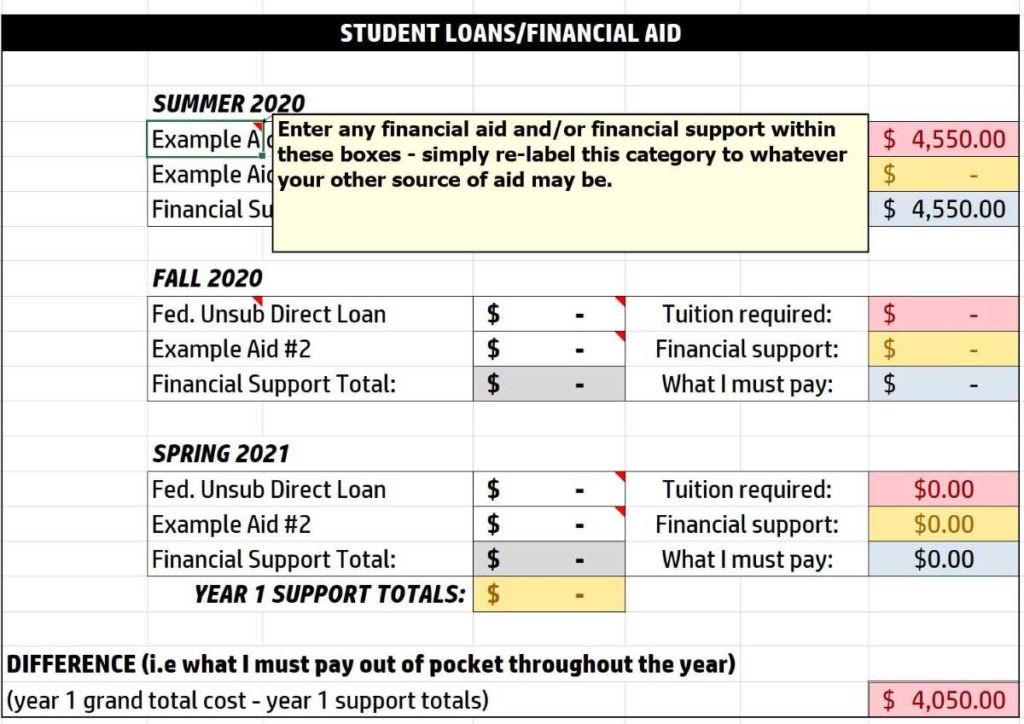

There’s also a section beneath each main column where you can add in your expected loans or other expenses in order to know how much money you’ll need to pay out of pocket or acquire through other loans.

Again, I’ve set up the spreadsheet so that Excel will do all of the calculations, so that you’ll know not just the gross amount of tuition fees, but also how much may be left over for you to pay after you enter in factors such as your loan amount(s) or scholarships, grants, etc.

Where you will need to input your information

There’s only a few areas on the spreadsheet where you will need to input your information. Let’s look at the screenshots below to help you learn where to input everything:

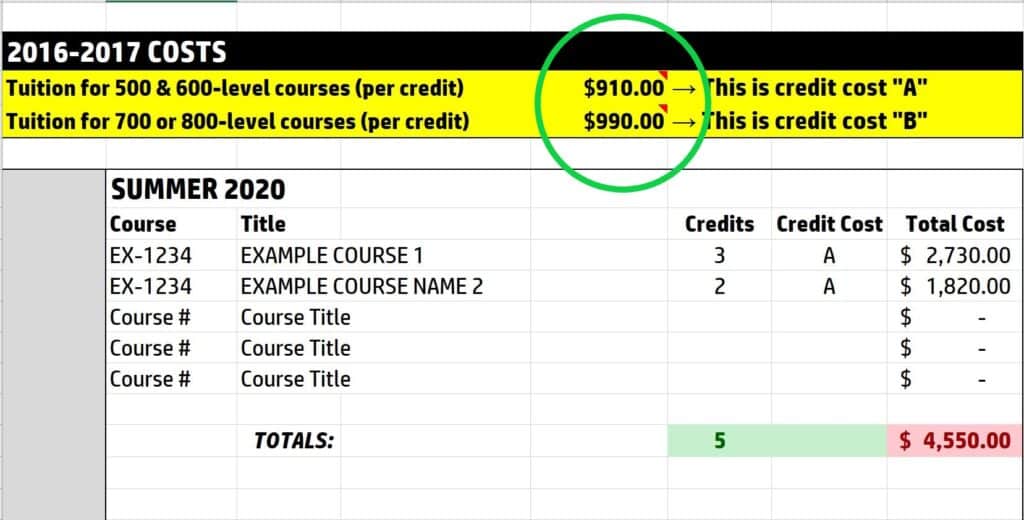

Inputting your credit hour costs

The first step to take within the spreadsheet is to input the credit hour cost (the yellow cells) at the top of each column. You’ll need to talk to your school, department, etc. in order to obtain this number/cost if it hasn’t already been given to you. Once you have that information, enter it into the box(es).

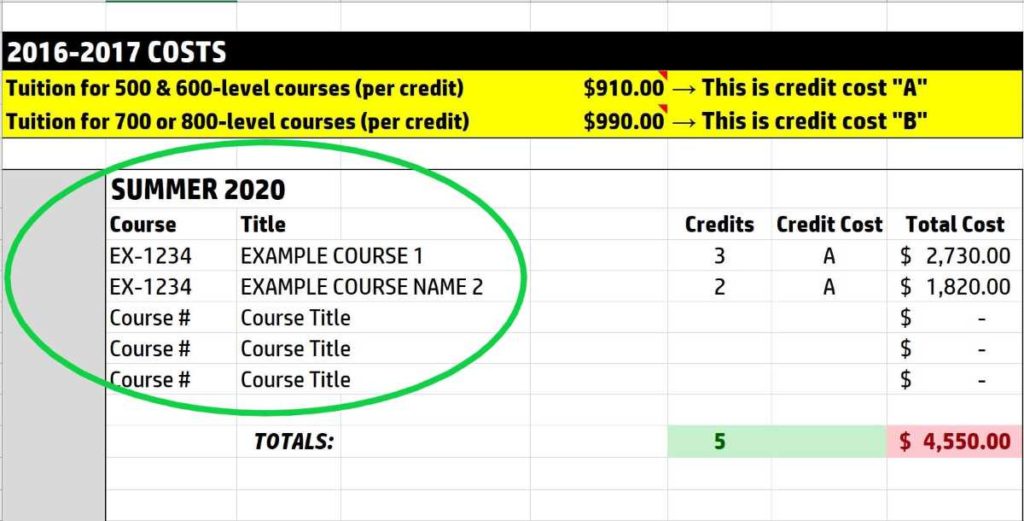

Inputting your course number, course name and credit amount

The next thing to do is to input your course numbers and course names for whichever semester you’re calculating. After having done this, be sure to then give a credit value to each course in the respective cell to the right of the course name.Once you’ve done this, be sure to then type either “A” or “B” into the respective cell, depending on the credit hour cost of that course. You will then instantly see Excel make calculations based on what you’ve inputted into other cells. If you have a course or lab, etc. that isn’t worth any credits, you can still include it on the list and just leave the “credits” and “credit costs” sections blank if you’d like.

Inputting any extra fees, your loans, scholarships, grants, etc.

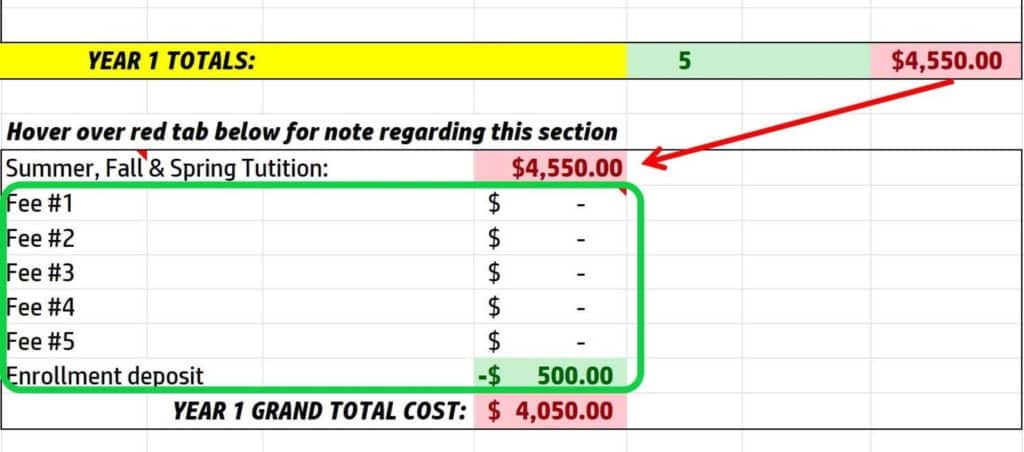

Underneath the main column where you list out your courses for the year, you’ll find a box directly below it where you can list any extra school-related fees that you might incur. Again, Excel will take care of the calculations for you, adding it to your running total for the school year.

Beneath that box you’ll find another box with a black banner at the top. Here you can input any sources of financial aid that you may be receiving for each semester. Just name the source of financial aid and put the respective values in the corresponding boxes. Do not enter anything into the grey box, as this box gives you a total value based on what you’ve entered above for any financial aid sources. Excel will continue to do all the calculations for you.

What the spreadsheet will calculate for you.

Once you plug in the information above, the spreadsheet will take care of the rest – you’ll be able to determine your tuition requirements for each semester, as well as for the entire year – so long as you know the courses you’ll be taking throughout each academic year.

Even if you don’t know the courses you’ll be taking beyond whichever semester you’re currently in, you can get a breakdown of the cost of that particular semester. This is how I wound up doing it, as I was never informed as to the courses I’d be taking for the following semester until a few weeks before that semester began.

Boxes with a red tab in the corner

A lot of the cells within the spreadsheet will have a red tab in their upper right-hand corner. If you’re not familiar with Excel, this is just a way to notify you that the particular cell has a note attached to it. To read the note, just hover the mouse icon over the cell and the note will pop up. I’ve included a lot of these notes just to help guide you when using and filling out the spreadsheet.

The potential for different credit hour costs

When it comes to the financial cost per credit hour of your courses, there’s potential for graduate students to have different costs per credit hour depending on the coursework that they’re taking. Lower level graduate courses can have a different credit-hour cost than compared to upper level courses.

This was the case for me when I was in PT school, and so as a result, I created the worksheet to be capable of calculating two different costs. If certain lower-level courses have a different fee than upper-level courses, you simply just have to let Excel know by either entering the letter “A” or the letter “B” in the box next to the credit worth of that particular course (see the image below). Again, use the reference spreadsheet if you need further help with this.

If your credit hour cost will be the same throughout your program, then all you have to do is type the credit hour cost into the respective cell at the top of the sheet while leaving the “credit cost B” cell empty.

Final remarks

I hope that this spreadsheet that I’ve made is able to help you out at least in some capacity. Financial stress that comes with graduate school, health professions school, PT school, or any other form of school can be stressful. Knowing exactly how much money you’ll be spending and how much money you’ll be needing each semester will hopefully alleviate that stress to one extent or another.

Again, feel free to modify the sheet however you need.

Click this link to download the Tuition Calculating Excel file.

Grind hard. You’ve got this!!

Hi! I’m Jim Wittstrom, PT, DPT, CSCS, Pn1.

I am a physical therapist who is passionate about all things pertaining to strength & conditioning, human movement, injury prevention and rehabilitation. I created StrengthResurgence.com in order to help others become stronger and healthier. I also love helping aspiring students and therapists fulfill their dreams of becoming successful in school and within their clinical PT practice. Thanks for checking out my site!