If you’re reading this article, it may just be because you (and I) are two of the 1.5 million individuals in the US with student loan debt. If you’re currently feeling like paying back your loans is crippling your life in one or more ways, this article should be able to help you out, but don’t expect sexy answers or amazing “secrets”.

If you do want a “secret” though, here’s one: The quickest way to become wealthy is to not be in debt.

I’ll give you a few more of these “secrets” throughout the article.

The quick answer for to how PT’s can pay off student loans quicker

While there are a number of specific steps to take that can be extremely beneficial for paying off student loans much more quickly, physical therapists wishing to pay back student loan debt must realize that there is no sexy answer when it comes to paying them back quicker. Just like how successful, efficient and quicker injury recovery requires consistent, active (and often uncomfortable) effort on the patient’s part in order to improve their physical situation, financial recovery from debt must be approached with the same mentality.

Paying off loans as quickly as possible is a product of developing a strict, written budget, sticking to it and never relying on the government to come through for you.

The quick overview of how to pay back your loans quicker

- Absolutely do not rely on federal student loan forgiveness programs

- Create a written budget and stick to it

- If you have multiple debts, consider using the debt-snowball method

- Learn to recognize the difference between what you want and what you need

- Consider taking up a second job

- Sell stuff that you don’t need.

Each of these points are discussed in greater detail within this article, so be sure to keep reading!

Fun fact: Student loan debt is non-bankrupt-able, meaning you only get rid of it either when you pay it off or you die.

Perhaps we should take a note from our dedicated patients we treat in the clinic

Before we dive into the strategies you can use to help take care of your student loan debt, we would be remiss to first not take a lesson from the lessons we can learn within the clinic itself:

Ever notice how the patients in your clinic who are dedicated, committed and willing to do whatever it takes to recover from their injury are the ones who have the best (and often quickest) outcomes? Take that mentality and imagine what that may look like if you plugged it into a “financial rehab” mentality for yourself.

Here’s another secret: Your level of intensity on paying back your loans dictates the level of sacrifice you’re willing to make

Just like we PT’s tell our patients that injury rehabilitation takes hard, deliberate, focused and consistent work, we must be aware that paying off debt is the same way. The patients in the clinic who put in the time and take their rehab seriously are always the ones that recover the quickest and experience the best results. They understand that they must oftentimes will willing to endure physical and even emotional discomfort. Why then would we think that rehabbing our our financial situation will be any different?

Patients who are dedicated towards and deliberately focused on improving their physical condition experience the best outcomes, often in the shortest time intervals. Improving our financial situation must be approached with the same mentality and same intensity if we’re serious about rehabbing our financial situation.

Tip 1: Absolutely do not rely on student loan forgiveness from the government

If you’re banking on working in the public sector as a means for the government to one day bail you out, you might as well just play the lotto instead and try to win it in order to pay off your debts that way.

Let me back up a bit for those who aren’t quite sure what I’m referring to:

In 2007, congress created the Public Service Student Loan Forgiveness Program. This program was created under the declaration that if graduates with federal student loan debt who worked in the pubic service sector for ten years (while simultaneously making monthly minimum payments throughout the process )would then have all remaining federal loan debt forgiven. Want to know how effective it’s been?

In 2017, 30,000 borrowers applied for loan forgiveness and a whopping 96 were approved for forgiven (i.e. less than 1%).

So, due to the outrage, the government THEN created the Temporary Expanded Public Service Loan Forgiveness Program, (which had fewer rules and regulations). As a result, over 54,000 people applied and a whopping 661 were approved.

Hooray for the program breaking the 1% acceptance rate (1.22% to be a bit more precise).

Your interest is still accruing as you make minimum payments

If you’re working in the public sector and are making your minimum payments until the ten-year mark, just remember that your Interest is still accruing over the 10 years you’re making your minimum payments. Odds are that you won’t be within the 1% that get their federal loans forgiven, so you’ll now have a larger balance to pay, assuming you’re part of the 99% who didn’t get their loans forgiven.

It’s also worth keeping in mind that congress can give and congress can take, meaning a current law regarding your student loans today can change tomorrow when the next congress comes in and completely negates it.

Just take it upon yourself to rehab your financial situation

Therefore, without me stepping up onto an even bigger soapbox, just take it upon yourself to repay your loans rather than hoping the government will, seeing how they have a terrible track record at this point in time. When you own your situation, you have the mental ability to do what it takes to correct it and overcome all unfavorable aspects you find yourself within.

That all being said, let’s look at what you can begin to do to start waging war against your loans and debt.

Tip 2: Create a written budget and stick to it

Your written budget is analogous to a home exercise program that you give your patients. It gives you direction, confidence and when adhered to consistently and properly will produce visible results for your financial rehab.

If you haven’t yet created a written budget, this is where you start. A written budget that requires you to know what your monthly spending requirements are for necessities as well as what your allowances are for non-essentials is analogous to doing an initial examination on your patient and following it up with implementing a home exercise program. This is your starting point that lets you get an overall picture of what’s going on and then subsequently figuring out how to best treat/attack the issue.

If you want to come up with a prognosis and treatment plan for your patient, you need to understand as much as possible about what’s going on with their situation.

Guess what? Your financial situation is the same way. You need to understand as much as possible with what’s going on with your monthly income and monthly expenses.

Use a free budgeting app to develop your budget

Having a visual overview that you can always look to and reference for all of your monthly income sources and expenses as well as amounts for each category is kind of like having having a medical chart for a patient you’re treating; it gives you the quick overviews you need and lets you know what needs to be addressed.

If you’re not the greatest with creating budgets, there’s great, free apps and websites that can help you out with this. My personal favourite is EveryDollar.com, which also has a mobile app as well. Mint.com is another great one. Both are free and will help you set up your monthly budgets.

This is where you get to begin to be brutally honest with yourself and see where you tend to over indulge. You also get to now set monthly limits for each category. Once you do this, you’ve now got a plan to adhere to. It’s not easy, but it’s certainly worth it.

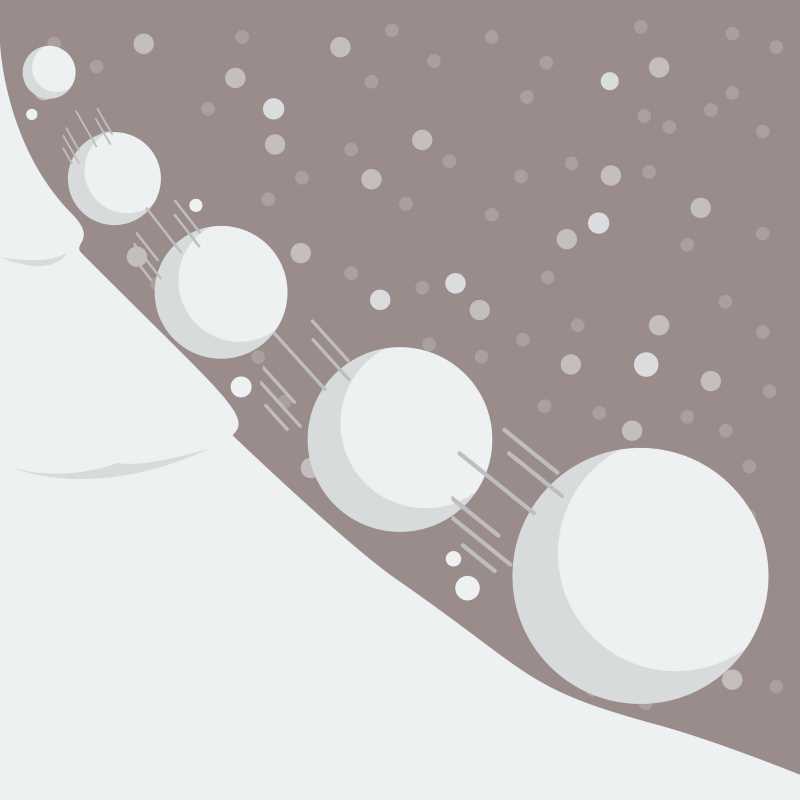

Tip 3: If you have multiple debts, consider using the debt-snowball

Many of us graduates have more than one source of debt. If this is the case with you, when it comes to paying everything off, there’s a tactic that’s termed “the debt-snowball” that can really help out with keeping progress rolling and making you feel quite empowered towards the progress you’re financially and visibly making.

How the debt snowball works

The debt snowball works by listing all your debts from smallest to largest. You then throw as much money as you can per month at the smallest debt, while only making minimum payments on your other debts. Once your smallest debt is eliminated, you then repeat the same tactic with your second smallest debt. Get that one eliminated and move on to the the next.

This approach is done regardless of the interest rates on each debt source you have. While some people don’t like the fact that you may not necessarily be attacking the highest-interest debt first, (which could potentially save you money in the long run depending on the situation), the debt snowball is used for another reason instead:

By eliminating your smallest debt, you begin to see and feel progress that you’re making. It’s incredibly motivating to cross a debt source off your list and see the difference you’re making in your debt pile each month.

Think of it this way: Patients whom we treat in the clinic often get further motivation and continue to stick with their rehabilitation program when they can see and feel the progress they’re making. If they don’t see or feel progress, they give up on the process or don’t pursue it as intensely as they should. Paying off debt works the same way for a lot of us.

Finding a way to thus gain psychological momentum can be a critical step to take when paying off debt.

The debt snowball method has been very empowering for me, personally

When I graduated, I listed out my debts and tried the debt snowball and it was incredibly motivating to watch my smallest debt get wiped out in a few months. I was out for blood when it came to paying off my credit card, which had thousands and thousands of dollars on it. Each month I made minimum payments on my other debts while throwing everything else at my credit card. Soon enough I got my credit card balance down to zero dollars.

Man, that pumped me up even more for next moving onto my personal line of credit. I visually tracked the process using a chart in Excel and watching the line drop closer and closer to zero kept me hungry and focused.

Tip 4: Learn to recognize the difference between what you want and what you need

This one can sting a bit and take a fair amount of honesty and discipline, but can save you from sinking your own ship.

Part of creating an effective budget is disseminating between your legitimate needs and your more nuanced wants that feel like needs.

As one of numerous potential examples: Big mistakes are often found in purchases of getting a new vehicle despite still having a high degree of student loan (or other) debt to pay off. You need a vehicle that is safe, yes, but if you can’t pay for another vehicle with cash, it’s likely not a wise purchase. Going into further debt to purchase another rapidly depreciating asset is like trying to treat and heal an acutely sprained ankle by doing miles and miles of trail running.

I’m not telling you how to live your life, you’re free to do what you want. I’m just reminding you that it’s tough to pay off your student loan debt when you’re now also making monthly car payments as well. This applies to far more than just vehicles, as I’m sure you know.

A personal example

I currently drive a car that is well-aged and beginning to really show signs of just how much it’s been through for the last nine years that I’ve been driving it (and I got it used). The mechanics tell me that it’s still safe to drive (can’t compromise on safety), but that there’s a lot of non-safety items that are in need of being replaced.

Do I like driving a vehicle with shocks that are shot or an interior that is decaying further day by day? Of course not. But what I like even more is taking what I’d be making for monthly payments on a new vehicle and instead put it right into loan repayments.

I came close to buying a new truck as soon as I graduated and am so glad that I didn’t (yes, I suffered from what I call “new-grad syndrome” temporarily). I’ve made the decision to stick with my old car that is hanging on for dear life, but is still reliable enough to get the job done for now.

When crunching the numbers, if I had bought the used truck I was looking at last year, by now I would have made about $7,000 in monthly payments at this point…but that 7k has gone back to loan repayments instead, and it feels truly amazing having done that.

As Dave Ramsay always says, “I’m not against you owning nice stuff, I’m just against nice stuff owning you.”

The bottom line: If you refrain from making purchases that you don’t truly need, you will have more money to throw at debt. This can be incredibly challenging, but if you’re able to remind yourself that it won’t last forever, it makes it much easier to endure.

This style of living takes an incredible amount of discipline (for me, anyways), and I’m not entirely perfect with it. But as I continue to practice it on a daily basis, my “discipline muscle” is definitely getting stronger and healthier. Discipline is simply the voluntary delay of gratification in order to achieve a greater goal.

So, consider applying this mentality to all realms of your life – knowing that you can indeed buy these things that you want one day, but that you’re just in a phase of your life where you can’t at this point in time.

Here’s another secret: The best vehicle to drive is the one you’re not making any payments on.

Tip 5: Consider taking up a second job

I told you these answers on how to pay off student loan debt weren’t going to be sexy, I only said that they’d be effective.

If there’s any way you can swing it, look at picking up a second job. Whether this is appropriate for you or not will of course depend on all of your individual life circumstances along with your level of intensity for taking control of your financial future, but even just working an extra 8 hours per week at another job will help.

If you can get a second job related to your expertise, it will of course likely pay a bit more than an area outside of your expertise, but even if your second job is just delivering pizzas, you can help yourself out quite a bit each month.

Remember: It won’t last forever!

How I’ve implemented this in my life

I currently work a second job 3-4 days a week immediately after finishing my shift at the clinic I work at full-time. I finish my shift and then immediately head to a facility up the street where I do personal training, a second love of mine.

It’s tough working 10 or 11 hour days, even when I enjoy both of my jobs. I work with great people at both my jobs, but it is very draining at times. Do I want to be working two jobs in this manner? Of course not. But each month I make a couple thousand extra dollars that I instantly convert into debt repayments. What this means is when it comes to my monthly student loan payments, I’m able to pay back at least twice the monthly minimum of what I owe.

It’s tough working so many hours just to turn it all back towards debt repayment…but somehow it’s simultaneously an empowering feeling knowing that you’re making great progress with getting out of debt.

Tip 6: Sell stuff that you don’t need

Ouch. Another stinger, perhaps.

If you’re out for blood when it comes to becoming student-loan free and debt-free in general, another potential option to think about is selling any of your belongings that you don’t necessarily need or can buy back/purchase again later on down the road when you’re no longer in debt.

It’s pretty amazing just how quickly this can add up. Once I finished PT school, I started looking around for things I owned that I either no longer needed or knew that I could live without for the next phase of my life.

I’ve sold things that I had no issue parting with and other things that would have been nice to hang onto. It’s not always fun parting with these things (but I can always buy them back later in life), but having sold a lot of non-essential belongings, I’ve made enough from it to take care of a couple of months of student loan repayments, meaning if it were originally going to take me an arbitrary number of years (let’s say 7) to pay back my student loans, just from selling a few things it will now take 6 years and 10 months. Doesn’t sound like much, perhaps but the sooner you’re debt-free, the better.

I’m not telling you that you have to do this, it’s always up to you and depends entirely on your situation. But this is a great step to take if you’re out for blood when it comes to paying off debts as quick as possible.

Concluding remarks

I don’t know where you’re at with your overall financial health and your current amount of financial debt. I also don’t know where you stand on determining how intensely you’re willing to pursue getting out of debt from the crippling amount of student loans we DPT graduates incur. This is all up to you, as you well know.

But if you’re serious about rehabbing your financial situation as quickly and effectively as you can, know that the principle of it is not all that different from a patient in the clinic who is serious about getting over their injury or condition as quickly and effectively as possible.

The outlook that you choose to adopt and the intensity that you choose to put towards your financial freedom is all up to you. Just remember that relying on other people to passively solve your problems isn’t going to pan out all that well for you. Take action, because active rehab trumps purely-passive rehab.

Paying off student loans will take a dedicated, regimented and persistent attitude that won’t be super enjoyable to go through. But rehab is never all that much fun. It also doesn’t last forever, so keep that in mind if you’re feeling like it’s time to take control of your future.

Figure out a budget, stick to it and be willing to delay gratification for a season of your life. People will think you’re weird for not being content with the fact that you have student loan debt. Just remember that if you do the things today that others won’t do, then tomorrow you’ll have the things that others won’t have.

Your financial freedom is waiting. Go make it happen.

Hi! I’m Jim Wittstrom, PT, DPT, CSCS, Pn1.

I am a physical therapist who is passionate about all things pertaining to strength & conditioning, human movement, injury prevention and rehabilitation. I created StrengthResurgence.com in order to help others become stronger and healthier. I also love helping aspiring students and therapists fulfill their dreams of becoming successful in school and within their clinical PT practice. Thanks for checking out my site!